Designed with uncommon flexibility to reduce risk

Robust tactical strategy for the U.S. equity market

A core asset allocation solution

Optimized exposure to reduce the volatility of real assets

VanEck’s Guided Allocation Suite

Designed with uncommon flexibility to reduce risk

With market conditions changing more rapidly from unexpected sources of risk, we saw an opportunity to improve asset allocation strategies. Our solutions possess the uncommon flexibility to adapt to changing market conditions — reducing the impact of losses inherent with strategic, buy-and-hold investments.

- When weathering market downturns, we recognize that sometimes no exposure is the best exposure.To effectively de-risk in bear markets, our Guided Allocation Suite can move 100% into cash in times of market stress.

- Yet, volatility also represents opportunity. Our solutions provide calibrated market exposure,following rules-based processes to minimize drawdowns while remaining poised to participate meaningfully when markets turn positive.

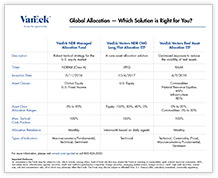

Download the Guided Allocation

Comparison Chart

VanEck Vectors® NDR CMG Long/Flat Allocation ETF (LFEQ®)

A robust tactical strategy for the U.S. equity market

Proprietary model continually measures market health, based on directional trends and a breadth of technical indicators, to make tactical allocation decisions

- When direction is positive, allocates 100% to the U.S. equity market

- When direction is negative, steps down its equity allocation with the ability to move 100% into cash

- Remains poised to participate fully once market direction turns positive

- Driven by the institutional expertise of Ned Davis Research, a leader with over 30 years of experience in comprehensive market research and economic analysis

For more details and performance information, visit LFEQ

VanEck NDR Managed Allocation Fund (NDRMX)

A core asset allocation solution

Designed to improve the return profile of a traditional 60/40 allocation mix with tactical allocations and enhanced risk management

- Allocates 0% to 90% to global stocks and U.S. fixed income with the flexibility to move significantly into cash

- Robust analysis combines macroeconomic, fundamental, and technical indicators

- Broad and cost effective exposure through highly liquid, U.S.-listed ETFs

- Objective, data-driven process developed by Ned Davis Research, a leader with over 30 years of experience in comprehensive market research and economic analysis

For more details and performance information, visit NDRMX

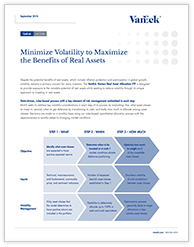

VanEck Vectors® Real Asset Allocation ETF (RAAX™)

Optimized exposure to reduce the volatility of real assets

Provides the potential benefits of real assets — hedge to inflation, low correlation to traditional asset classes, and participation in global growth

- Comprehensive exposure across commodities, natural resource equities, REITs, MLPs, and infrastructure

- Seeks to reduce volatility by responding to changing market environments including the ability to allocate 100% to cash

- Optimized allocation process provides exposure to segments with positive expected returns while managing overall portfolio risk and drawdowns

- Data-driven, rules-based with key element of risk management embedded in each step of process

- Draws on VanEck’s long history of experience and insight in this sector

For more details and performance information, visit RAAX

Discover Exceptional Value

Go ▸Ask Our Thought Leaders

Submit QuestionsLearn With Guided Allocation Insights Delivered To Your Inbox

IMPORTANT DISCLOSURES

An investment in the Funds may be subject to risks which include, among others, fund of funds risk which may subject the Funds to investing in commodities, gold, natural resources companies, MLPs, real estate sector, infrastructure, equities securities, small- and medium-capitalization companies, foreign securities, emerging market issuers, foreign currency, credit, high yield securities, interest rate, call and concentration risks, all of which may adversely affect the Funds. The Funds may also be subject to affiliated fund, U.S. Treasury Bills, subsidiary investment, commodity regulatory, tax, liquidity, gap, cash transactions, emerging markets, investment style, small-, medium- and large-capitalization companies, high portfolio turnover, model and data, management, operational, authorized participant concentration, absence of prior active market, trading issues, market, fund shares trading, premium/discount and liquidity of fund shares, and non-diversified risks. The Funds’ assets may be concentrated in a particular sector and may be subject to more risk than investments in a diverse group of sectors. You can lose money by investing in the Funds. Any investment in a Fund should be part of an overall investment program rather than a complete program.

RAAX™ and LFEQ® Fund shares are not individually redeemable and will be issued and redeemed at their net asset value (NAV) only through certain authorized broker-dealers in large, specified blocks of shares called "creation units" and otherwise can be bought and sold only through exchange trading. Shares may trade at a premium or discount to their NAV in the secondary market. You will incur brokerage expenses when trading Fund shares in the secondary market. Past performance is no guarantee of future results. Returns for actual Fund investments may differ from what is shown because of differences in timing, the amount invested, and fees and expenses.

Investing involves substantial risk and high volatility, including possible loss of principal. Bonds and bond funds will decrease in value as interest rates rise. An investor should consider the investment objective, risks, charges and expenses of the Funds carefully before investing. To obtain a prospectus and summary prospectus for VanEck Funds and VanEck Vectors ETFs, which contains this and other information, call 800.826.2333 or visit vaneck.com. Please read the prospectus and summary prospectus carefully before investing for VanEck Funds and VanEck Vectors ETFs.

Van Eck Securities Corporation, Distributor

666 Third Avenue

New York, NY 10017

800.826.2333